- The SA Reserve Bank's Monetary Policy Committee has left SA's interest rate unchanged.

- The repo rate has remained at 8.25% since May last year.

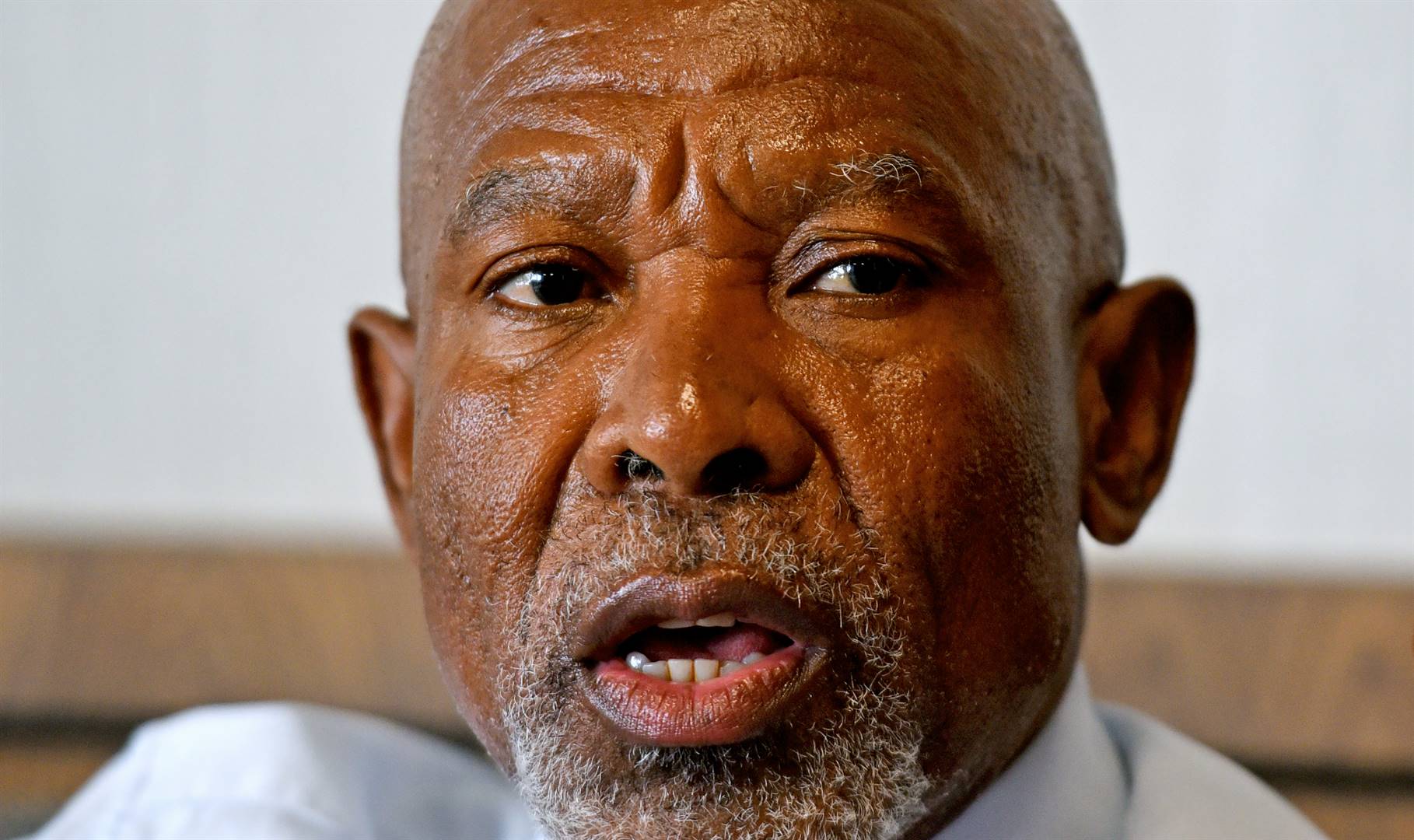

- Reserve Bank Governor Lesetja Kganyago says inflation expectations remain stubbornly high.

- For more financial news, go to the News24 Business front page.

As expected, interest rates were left unchanged for the fifth consecutive Monetary Policy Committee (MPC) meeting on Wednesday afternoon.

The committee's decision was unanimous. SA Reserve Bank Governor Lesetja Kganyago said in his presentation in Pretoria that risks remained to SA's inflation expectations.

The repo rate has remained at 8.25% - its highest level in 15 years – since May last year. During the pandemic, the rate dipped to 3.50%. Since then, the monthly payment on a new R2 million home loan (at the prime rate) has climbed from around R15 500 (7%) to almost R22 700 (11.75%).

Inflation remains unexpectedly hot in South Africa, due in part to steep fuel price hikes. Consumer inflation reached 5.6% last month – far above the 4.5% sweet spot the central bank is aiming for.

"The return to target has been slow," said Kganyago. "We still see headline inflation heading back to 4.5%. However, given extra inflation pressure, headline now reaches the target midpoint only at the end of 2025, later than previously expected."

South Africa may have to wait for the US to take the lead with interest rate cuts. The rand is at risk of a sell-off if global investors can earn higher interest rate returns elsewhere.

Electricity woes

Kganyago said that Reserve Bank forecasts indicated a "modest growth acceleration from this year" to 1.2% based on an expected decrease in power cuts.

SA's struggling economy performed worse than expected in the fourth quarter of 2023, expanding by just 0.1%. Growth for 2023 was only 0.6%.

"We expect the load shedding burden will ease somewhat. While we estimate electricity shortages took 1.5 percentage points off GDP last year, we think this will moderate to 0.6 percentage points this year and 0.2 percentage points in 2025," he said.

"Overall, we see growth at 1.2% this year, improving to 1.6% by 2026. These projections are better than the 2023 outcome, but below longer-run averages, which are around 2%."

Publications

Publications

Partners

Partners